Introduction to MetaTrader 4 for Windows

Posted by | Categories: Service

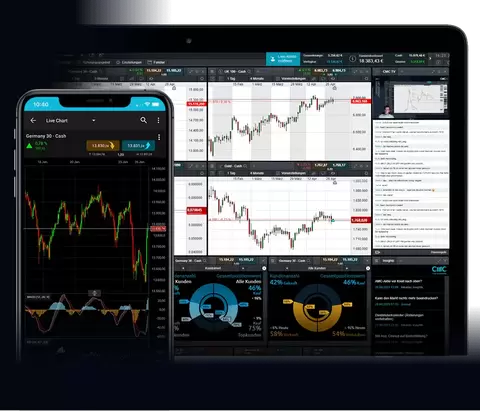

In the realm of online trading, MetaTrader 4 (MT4) stands out as one of the most popular and reliable platforms available today. Whether you’re a novice trader or a seasoned professional, MT4 offers a robust suite of tools and features designed to enhance your trading experience. This article provides an introduction to metatrader 4 for windows, outlining its key features and benefits.

What is MetaTrader 4?

MetaTrader 4, developed by MetaQuotes Software, is a sophisticated trading platform used by millions of traders worldwide. It enables users to trade various financial instruments, including forex, commodities, indices, and cryptocurrencies. MT4 is particularly renowned for its user-friendly interface, advanced charting capabilities, and automated trading options.

Key Features of MetaTrader 4 for Windows

1. User-Friendly Interface

One of the primary reasons for MT4’s widespread adoption is its intuitive and user-friendly interface. The platform is designed to be accessible for traders of all skill levels. The layout is customizable, allowing you to arrange charts, indicators, and other tools to suit your trading style.

2. Advanced Charting Tools

MT4 offers an extensive array of charting tools that help traders analyze market trends and make informed decisions. You can access multiple chart types, timeframes, and over 30 built-in technical indicators. Additionally, the platform supports custom indicators, enabling you to tailor your analysis to your specific needs.

3. Automated Trading

Automated trading is one of MT4’s standout features. The platform supports Expert Advisors (EAs), which are automated trading algorithms that can execute trades on your behalf. You can either develop your own EAs using the MQL4 programming language or choose from a vast library of pre-made EAs available in the marketplace.

4. Secure and Reliable

Security is paramount when it comes to online trading, and MT4 takes this seriously. The platform employs robust encryption protocols to ensure the safety of your data and transactions. Additionally, MT4 is known for its reliability, with minimal downtime and fast execution speeds.

5. Extensive Support and Resources

MetaTrader 4 boasts a large and active community of users, which means you’ll have access to a wealth of resources and support. From forums and tutorials to webinars and customer service, you’ll never be short of guidance and assistance.

Getting Started with MetaTrader 4 for Windows

To start trading with MT4 on Windows, follow these simple steps:

1. Download and Install: Visit the official MetaTrader 4 website or your broker’s website to download the platform. Follow the installation instructions to set it up on your Windows device.

2. Create an Account: Once installed, open MT4 and create a trading account with your preferred broker.

3. Fund Your Account: Deposit funds into your trading account to start trading.

4. Explore the Platform: Familiarize yourself with the platform’s features by exploring the various menus, tools, and settings.

5. Start Trading: Use the charting tools and indicators to analyze the market and place your trades.

Conclusion

MetaTrader 4 for Windows is a powerful and versatile trading platform that caters to the needs of both beginner and advanced traders. Its user-friendly interface, advanced charting tools, automated trading capabilities, and robust security make it an excellent choice for anyone looking to enhance their trading experience. By understanding and utilizing the features of MT4, you can take your trading to the next level.

CFD Trading Platforms: Choosing the Right One for You

Posted by | Categories: Service

CFD how it works have become increasingly popular among traders seeking opportunities to profit from the price movements of various financial assets. This rise can be attributed to several key factors that have reshaped the dynamics of the financial markets and created new avenues for investment.

One of the significant advantages of CFD trading is the ability to access diverse markets from a single platform. Unlike traditional investment methods that may require separate accounts or brokers for different asset classes, CFD brokers typically offer a wide range of instruments, including stocks, indices, currencies, commodities, and cryptocurrencies. This level of market access allows traders to capitalize on emerging trends and global economic developments across multiple asset classes.

Another opportunity presented by CFD trading is the potential for both long and short positions. Unlike traditional stock trading, where investors can only profit from rising prices, CFDs enable traders to profit from both upward and downward price movements. This versatility is particularly valuable in volatile markets, where traders can capitalize on market fluctuations regardless of the direction of the trend.

Additionally, CFD trading offers traders the flexibility to trade on margin, which means they can enter positions with only a fraction of the total value of the underlying asset. This leverage feature allows traders to amplify their exposure to the market, potentially increasing their profits. However, it’s essential to note that leverage also magnifies losses, so prudent risk management is crucial.

Furthermore, CFD trading provides opportunities for traders to implement various trading strategies, from day trading to trend following and hedging. With access to advanced charting tools, technical analysis indicators, and real-time market data, traders can make informed decisions and execute their strategies with precision.

In conclusion, Contracts for Difference (CFDs) offer a range of opportunities for traders to profit from the dynamic movements of financial markets. From diverse market access to the ability to trade on margin and implement various trading strategies, CFDs have emerged as a versatile and accessible instrument for both retail and institutional investors alike. However, it’s essential for traders to approach CFD trading with caution and to educate themselves about the associated risks.