Ernest Varvoutis Boca Raton Florida Tips For Family Budgeting Made Simple

Posted by | Categories: Service

How To Budget For A Family Of Four On A Limited Income By Ernest Varvoutis Boca Raton Florida

Hi there! Managing a household on a tight budget isn’t easy, especially when you’ve got a family of four. But don’t stress—it’s totally doable with the right plan. Ernest Varvoutis Boca Raton Florida, a financial expert known for practical advice, says, “Budgeting is about being intentional with what you have.” Let’s break it down step by step to keep your family financially secure and happy.

Step 1: Assess Your Income and Expenses

Start by figuring out exactly how much money is coming in and where it’s going. Write down all your income and list every monthly expense, from rent to snacks for the kids. This gives you a clear picture of your finances.

Step 2: Prioritize The Essentials

Focus on needs first:

• Housing

• Utilities

• Food

• Transportation

Once these are covered, allocate what’s left to savings, debt repayment, and non-essentials. As Ernest Varvoutis Boca Raton Florida says, “A budget isn’t restrictive—it’s a roadmap for what matters most.”

Step 3: Cut Unnecessary Costs

Look for areas to trim expenses without feeling deprived:

• Cook at home instead of eating out.

• Cancel unused subscriptions.

• Shop for clothes or items during sales or secondhand.

Step 4: Plan Meals And Groceries

Meal planning can save a ton of money. Create a weekly menu, stick to a shopping list, and avoid impulse buys. Cooking in bulk can also help stretch your budget.

Step 5: Save A Little, Even On A Tight Budget

It might seem impossible, but even small savings add up. Set aside a tiny amount each month for emergencies or future needs.

Budgeting for a family on a limited income is challenging but achievable. Stay consistent and adjust as needed. As Ernest Varvoutis Boca Raton Florida wisely says, “Every small step toward financial control makes a big difference.” You’ve got this!

The Benefits of Using Funded Trading Accounts for Your Growth

Posted by | Categories: Service

Success in trading often hinges on access to capital, sound strategy, and minimizing risk. For aspiring traders looking to gain experience and grow without putting their personal savings on the line, funded trading accounts have emerged as a compelling solution. These accounts allow traders to operate with someone else’s capital, sharing a portion of their profits in exchange. But what makes funded trading accounts such an attractive choice for growth? Let’s break it down.

Risk-Free Exposure to Large Capital

One of the most significant advantages of funded accounts lies in the access they provide to larger trading capital. Many traders are held back by limited personal funds, which can restrict their ability to explore and achieve meaningful returns. A funded trading account eliminates this barrier. Traders can focus on mastering the market without the constant fear of losing their personal savings, offering a safe environment to improve their skills.

Additionally, most funded accounts set strict risk parameters, ensuring traders don’t overextend themselves. According to industry data, funds with strong risk control policies report higher trader retention and success rates—offering proof that lower personal risk leads to better decision-making.

Accelerated Learning for Aspiring Traders

Funded accounts create a hands-on learning environment. Instead of relying solely on hypothetical strategies or demo accounts, traders can experience real-world conditions. Industry reports suggest that traders operating in live markets adapt 50% faster than those using simulated conditions, as the stakes drive more engagement and focus.

The structured evaluations that funded accounts often require before granting capital also prepare traders. These assessments ensure that individuals have the necessary skills to perform under pressure, instilling sustainable trading habits crucial for long-term success.

Shared Profits, Shared Growth

Profit splits—usually ranging from 50% to 80%—are common in funded trading arrangements. While sharing profits might seem like a downside, it motivates traders to push for consistent gains while prioritizing careful risk management. Research shows that traders who grow their performance steadily over time tend to maintain higher profitability levels compared to those obsessing over quick wins.

This profit-based collaboration benefits both the trader and the funding entity, fostering mutual growth. With the proper mindset, the earnings from funded accounts can transition traders into self-reliance, equipping them to manage independent portfolios in the future.

Expand Your Financial Horizons

Funded trading accounts represent a stepping stone for traders who want to gain practical experience, access greater capital, and build confidence without risking personal wealth. By maintaining disciplined strategies and leveraging opportunities for growth, traders can maximize both short-term achievements and long-term career potential.

How to Integrate Technical and Fundamental Analysis on MT4 Trading Platform

Posted by | Categories: Service

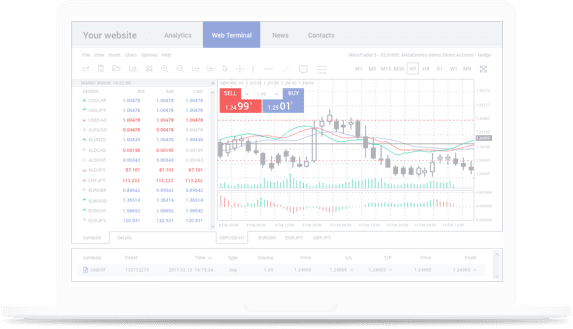

Traders often rely on two key methods to make informed market decisions—technical analysis and fundamental analysis. While both approaches have their unique benefits, integrating them on the mt4 trading platform can provide a comprehensive trading strategy. This blog explores how to effectively combine these techniques to improve your trading outcomes.

What is Technical Analysis?

Technical analysis involves studying price charts, patterns, and technical indicators to predict market movements. It’s all about observing past price data to anticipate future price trends. Tools like moving averages, RSI (Relative Strength Index), and Fibonacci retracement are commonly used to identify entry and exit points.

Technical analysis is ideal for traders looking to capitalize on short-term price fluctuations. However, it lacks insight into why these price changes occur, which is where fundamental analysis comes in.

What is Fundamental Analysis?

Fundamental analysis focuses on the intrinsic value of an asset by studying factors such as economic indicators, interest rates, and market sentiment. It involves analyzing external events and news releases to estimate the long-term price potential of an asset. For instance, a strong GDP figure might indicate a bullish outlook for a currency.

Fundamental analysis helps traders understand the underlying reasons for price movements, offering a broader perspective on the market’s direction.

Combining Technical and Fundamental Analysis

When integrated, technical and fundamental analysis work together to refine your trading decisions. Here’s how to do it effectively:

Step 1: Analyze the Fundamental Context

Begin by studying fundamental market drivers. Monitor news reports, economic calendars, and geopolitical events. Identify the overall market sentiment–whether it’s bullish, bearish, or neutral.

Step 2: Use Technical Tools for Precision

Once the fundamental context is clear, apply technical analysis to pinpoint entry and exit levels. For example, if fundamentals suggest a positive outlook for a currency, use chart patterns or indicators like moving averages to identify the ideal buy zones.

Step 3: Time Your Trades

Combine insights from both analyses to fine-tune trade timing. For instance, wait for a technical breakout confirmation after positive fundamental news aligns with your strategy.

The Benefits of Integration

Integrating these two approaches provides a balanced trading strategy. Fundamental analysis offers context, while technical analysis ensures precision. Together, they improve decision-making and mitigate potential risks.

Final Thoughts

Balancing technical and fundamental analysis on platforms like MT4 can take your trading to the next level. By combining market trends with broader economic factors, traders can achieve a more holistic view of the market, leading to better-informed decisions.