Traders often rely on two key methods to make informed market decisions—technical analysis and fundamental analysis. While both approaches have their unique benefits, integrating them on the mt4 trading platform can provide a comprehensive trading strategy. This blog explores how to effectively combine these techniques to improve your trading outcomes.

What is Technical Analysis?

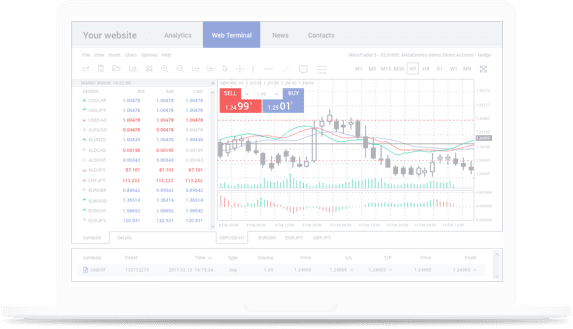

Technical analysis involves studying price charts, patterns, and technical indicators to predict market movements. It’s all about observing past price data to anticipate future price trends. Tools like moving averages, RSI (Relative Strength Index), and Fibonacci retracement are commonly used to identify entry and exit points.

Technical analysis is ideal for traders looking to capitalize on short-term price fluctuations. However, it lacks insight into why these price changes occur, which is where fundamental analysis comes in.

What is Fundamental Analysis?

Fundamental analysis focuses on the intrinsic value of an asset by studying factors such as economic indicators, interest rates, and market sentiment. It involves analyzing external events and news releases to estimate the long-term price potential of an asset. For instance, a strong GDP figure might indicate a bullish outlook for a currency.

Fundamental analysis helps traders understand the underlying reasons for price movements, offering a broader perspective on the market’s direction.

Combining Technical and Fundamental Analysis

When integrated, technical and fundamental analysis work together to refine your trading decisions. Here’s how to do it effectively:

Step 1: Analyze the Fundamental Context

Begin by studying fundamental market drivers. Monitor news reports, economic calendars, and geopolitical events. Identify the overall market sentiment–whether it’s bullish, bearish, or neutral.

Step 2: Use Technical Tools for Precision

Once the fundamental context is clear, apply technical analysis to pinpoint entry and exit levels. For example, if fundamentals suggest a positive outlook for a currency, use chart patterns or indicators like moving averages to identify the ideal buy zones.

Step 3: Time Your Trades

Combine insights from both analyses to fine-tune trade timing. For instance, wait for a technical breakout confirmation after positive fundamental news aligns with your strategy.

The Benefits of Integration

Integrating these two approaches provides a balanced trading strategy. Fundamental analysis offers context, while technical analysis ensures precision. Together, they improve decision-making and mitigate potential risks.

Final Thoughts

Balancing technical and fundamental analysis on platforms like MT4 can take your trading to the next level. By combining market trends with broader economic factors, traders can achieve a more holistic view of the market, leading to better-informed decisions.