CFD how it works have become increasingly popular among traders seeking opportunities to profit from the price movements of various financial assets. This rise can be attributed to several key factors that have reshaped the dynamics of the financial markets and created new avenues for investment.

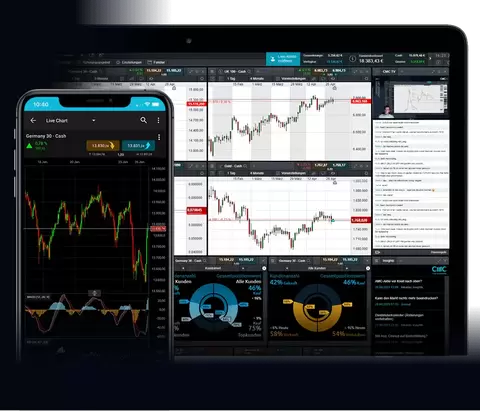

One of the significant advantages of CFD trading is the ability to access diverse markets from a single platform. Unlike traditional investment methods that may require separate accounts or brokers for different asset classes, CFD brokers typically offer a wide range of instruments, including stocks, indices, currencies, commodities, and cryptocurrencies. This level of market access allows traders to capitalize on emerging trends and global economic developments across multiple asset classes.

Another opportunity presented by CFD trading is the potential for both long and short positions. Unlike traditional stock trading, where investors can only profit from rising prices, CFDs enable traders to profit from both upward and downward price movements. This versatility is particularly valuable in volatile markets, where traders can capitalize on market fluctuations regardless of the direction of the trend.

Additionally, CFD trading offers traders the flexibility to trade on margin, which means they can enter positions with only a fraction of the total value of the underlying asset. This leverage feature allows traders to amplify their exposure to the market, potentially increasing their profits. However, it’s essential to note that leverage also magnifies losses, so prudent risk management is crucial.

Furthermore, CFD trading provides opportunities for traders to implement various trading strategies, from day trading to trend following and hedging. With access to advanced charting tools, technical analysis indicators, and real-time market data, traders can make informed decisions and execute their strategies with precision.

In conclusion, Contracts for Difference (CFDs) offer a range of opportunities for traders to profit from the dynamic movements of financial markets. From diverse market access to the ability to trade on margin and implement various trading strategies, CFDs have emerged as a versatile and accessible instrument for both retail and institutional investors alike. However, it’s essential for traders to approach CFD trading with caution and to educate themselves about the associated risks.